You know you need insurance. It’s the cornerstone of any solid financial plan, the safety net that protects your family, your assets, and your future from life’s unexpected blows. But let’s be honest: for most Americans, navigating the world of insurance is confusing, frustrating, and often expensive.

You’re bombarded with ads from Flo, the Gecko, and Mayhem. You get stacks of complicated policy documents filled with legalese. And you’re left wondering: Am I actually covered? Am I paying too much?

You’re not alone. A 2023 study by the Insurance Information Institute found that over 40% of US homeowners are unsure about what their policy actually covers.

This guide cuts through the noise. We’re going beyond basic definitions to provide a fresh, strategic look at US insurance in 2025. This is your actionable blueprint to understanding your policies, identifying critical coverage gaps, and implementing expert strategies to ensure you’re protected—without overpaying.

Part 1: The Pillars of Protection – A Modern Look at Core Policies

1. Auto Insurance: Beyond State Minimums

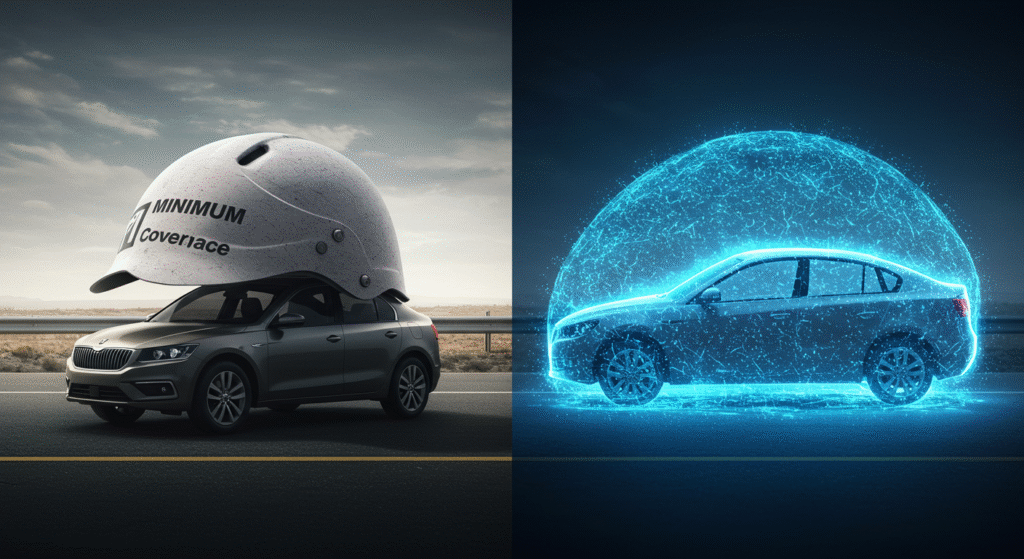

Driving with only your state’s minimum liability coverage is like wearing a paper helmet. It might technically check a box, but it offers little real protection.

Uninsured/Underinsured Motorist (UM/UIM) coverage is no longer optional. With rising repair costs and medical expenses, a minor accident can lead to major financial ruin. If you’re hit by a driver with minimal insurance, UM/UIM covers your medical bills and losses. Expert Tip: Match your UM/UIM limits to your bodily injury liability limits. It’s one of the most cost-effective upgrades you can make.

- Actionable Strategy: Increase your deductible. If you have a healthy emergency fund, raising your comprehensive and collision deductible from $500 to $1,000 can slash your premium by 15% or more. You’re betting on yourself to be a safe driver—and the savings add up year after year.

2. Homeowners Insurance: The Gaps You Didn’t Know You Had

Your home is likely your largest asset. Standard policies (HO-3) are good, but they have glaring exclusions.

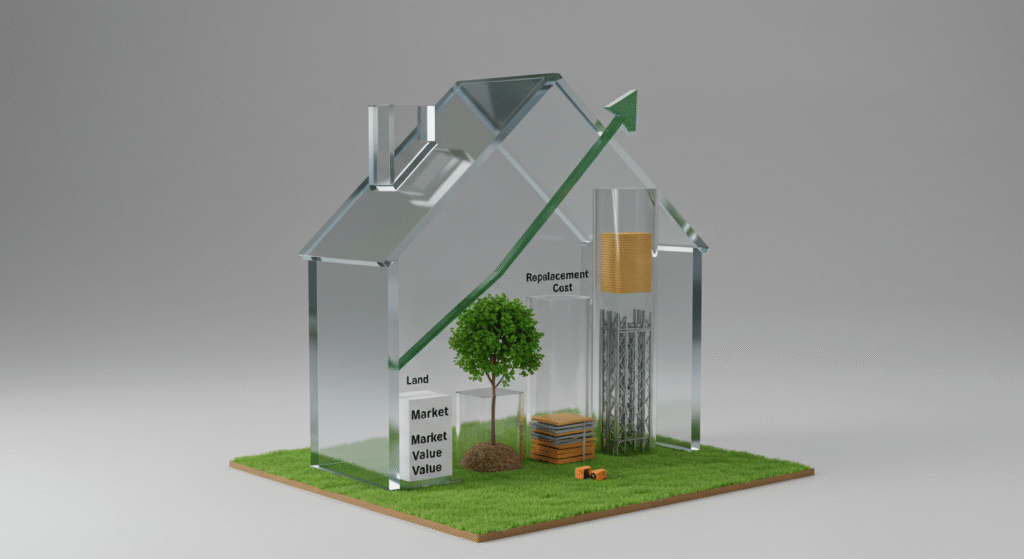

- The Fresh Insight (2024):“Replacement Cost” ≠ “Market Value.” Market value includes the land your house is on. Replacement cost is the price to rebuild your home from the ground up with current materials and labor. With construction costs soaring, you must ensure your dwelling coverage is based on a current replacement cost estimate, not what you paid for the house.

- Critical Check: Call your agent today to verify your dwelling coverage limit is adequate.

- Actionable Strategy: Schedule your jewelry, art, and tech. Standard policies have low sub-limits for theft of valuable items (e.g., $1,500 for jewelry). If you have an engagement ring, luxury watch, or high-end electronics, a “scheduled personal property” floater provides full, all-risk coverage for a few dollars more per year.

3. Health Insurance: Navigating the New Landscape

Health insurance remains one of the most complex areas for Americans.

- The Fresh Insight (2024):It’s not just about the premium. The real cost is in the deductible, out-of-pocket maximum, and network. A cheaper plan with a narrow network could cost you tremendously if your preferred doctor or hospital isn’t in-network.

- HSA-Eligible Plans (HDHPs): These High-Deductible Health Plans paired with a Health Savings Account (HSA) are powerful triple-tax-advantaged tools for savvy savers. Contributions are tax-deductible, growth is tax-free, and withdrawals for qualified medical expenses are tax-free. They are a fantastic long-term wealth-building vehicle.

- Actionable Strategy: Don’t just auto-renew during Open Enrollment. Your plan changes every year. Providers leave networks, drug formularies change, and premiums adjust. Shop and compare on the Healthcare.gov marketplace or your state exchange every single year.

4. Life Insurance: It’s About Income Replacement

Life insurance isn’t for the dead; it’s for the living. It replaces lost income so your family can stay in their home, pay for college, and maintain their standard of living.

- Term is best for 95% of people. Forget complex whole life or universal life policies unless you have a very high net worth and specific estate planning needs. A 20- or 30-year level term policy is simple, affordable, and provides the pure protection most families need during their highest-risk years (e.g., while paying a mortgage or raising kids).

- Actionable Strategy: Calculate your real need. A simple formula: (Annual Income x 10) + Outstanding Debt (Mortgage) + Future College Costs. This ballpark figure ensures your family is truly secure.

Part 2: The Expert’s Playbook: 5 Pro Strategies to Slash Premiums in 2024

- Bundle and Save (The Right Way): Bundling auto and home with one carrier can net you a discount of 15-25%. However, don’t bundle blindly. Get individual quotes first to ensure the “discount” is actually a better overall price.

- Embrace Telematics: Usage-based insurance programs (like Progressive’s Snapshot or Allstate’s Drivewise) monitor your driving habits. Safe drivers can see discounts of 10-30%. If you’re a low-mileage, safe driver, this is a no-brainer.

- Ask About Hidden Discounts: Companies offer discounts you have to ask for: paperless billing, pre-pay discounts, professional organization memberships (e.g., alumni associations), good student discounts, and even discounts for paying in full.

- Regularly Shop Around: Loyalty often costs you. Market rates change. Make it a habit to get competitive quotes from at least three insurers every 2-3 years. This is the single most effective way to ensure you’re not overpaying.

- Review and Re-qualify: Life changes. Got married? Got a raise? Paid off your car? Improved your credit score? These events can qualify you for new discounts or lower rates. Inform your insurer proactively.

Part 3: The Final Word: Your Annual Insurance Check-Up

Your insurance needs are not static. An annual review is as important as a doctor’s physical.

Your 15-Minute Insurance Audit:

- Policies: Pull out your auto, home, and life insurance documents.

- Coverage: Have your assets or income increased? Update your limits accordingly.

- Deductibles: Can you afford a higher deductible to save on premiums?

- Discounts: Call your provider and ask, “What discounts am I eligible for that I’m not currently receiving?”

- Shop: Spend 30 minutes on comparison sites or with an independent agent to get new quotes.

Conclusion: Peace of Mind is Priceless

Insurance is a contract of promise. It’s the promise that after a car crash, a house fire, or the unthinkable loss of a loved one, your financial world won’t also collapse. By taking a strategic, informed approach, you transform this necessary expense from a confusing burden into a powerful tool for financial resilience.

Don’t set and forget your policies. Use this guide as your roadmap to build a smarter, stronger safety net for everything you’ve worked so hard to build.